Business bank accounts for sole traders

If you’re a freelancer or sole trader, separating your personal and business finances into separate bank accounts is the easiest way to simplify your accounting.

Article contents

− +

Banking can get complicated for freelancers, especially if you’re just starting out. Setting up the right accounts is important, and can save you major headaches when it comes time to file your taxes.

If you have questions about which bank accounts you should be using and how to simplify your money management, we’ve got the advice you need.

What bank accounts do sole traders need?

If you’re like many people, you’ve probably only had two bank accounts up to now: a personal account and a savings account. But as a freelancer, you will need to set up a couple of new bank accounts to make sure your money always lands in the right place.

Business transaction account

This is the account you will use to accept payments from clients. It functions just like a normal transaction account, except the bank and the Australian Tax Office (ATO) will see that it’s associated with your business, which is important when you file taxes.

You will also use this account for any business expenses you may have, including software, supplies, or office space rentals. Mixed expenses used for both business and personal reasons such as phone or utility bills should also be paid from this account. We’ll show you how to parcel these out appropriately later on in the article.

Business savings account

This account isn’t required but is sometimes included at no cost when you set up a business transaction account. (It’s useful having an extra account, so it’s worth shopping around to find a bank account that includes a free savings account.)

It’s not a bad idea to use this account as an emergency fund—if you have unexpected business costs, you can withdraw some money from your business savings into your business transaction account to cover it.

You can also use your business savings account to store money you’ve set aside to pay your freelance taxes. Business savings accounts usually earn interest (provided you keep a minimum amount in the account), so if you have money that you will be holding on to for a long time, it pays—quite literally—to keep it stored in this account.

How to find the right business bank account for you

It’s relatively easy to set up a business bank account, but choosing the right bank can be tricky because there are so many options.

The first big question: Should you go for one of the big four banks (Westpac, ANZ, NAB, and Commonwealth), or should you branch out and try a different bank?

If you are already using a bank for your personal accounts, the easiest option may be to set up your business bank accounts with the same institution. This will make it easier for you to transfer finances as needed from one account to another, without too much hassle.

If you’re looking to find a new bank for your business accounts, you could consider one of the newer banks that have popped up in recent years, many of which are exclusively online, including Up Bank or 86 400.

Ultimately, it comes down mostly to personal preference, as most banks offer the different types of accounts you need. Consider how important it is to be able to go into a physical bank—if that’s something you value, then avoid choosing an online-only bank.

The best bet when looking for a new bank is to use tools like Finder or Canstar, which let you compare business bank accounts side by side.

As you are comparing, take these factors into consideration:

Are there excessive monthly fees or ATM charges?

What is their online or mobile banking service like?

Do they offer any perks, like cash back or a bonus for opening the account?

Is the bank part of the Open Banking initiative?

If you plan to travel or become a digital nomad, how well do these banks work overseas?

Does it come with a bank card to use for purchasing?

It’s up to you to decide how important these questions are for you, but this should help you narrow down the list and find the best option.

After that’s done, it’s quite simple to set up a business bank account. This can often be done online in just a few clicks, but if you prefer, you can visit a nearby branch and go through the setup process with a bank employee.

How to manage your money in your new bank accounts

Now that you’ve gone through the process of setting up the accounts, you’ll find it’s much easier to keep your cash flow and expenses in order. Here’s a quick guide on how to sort your finances going forward:

1. Payments come into your business bank account

Any time you get paid by a client or customer, the funds should go directly into your business bank account. If you use Rounded to send custom invoices, it’s very simple to update your banking information so that payments come directly into the right account.

2. Set aside taxes in your business savings account

As a sole trader, you most likely pay quarterly taxes. This means you need to be proactive, setting aside the right amount of money every time you get paid, so that you don’t accidentally spend it. If you know which income bracket you fall into, you can easily figure out a quick formula to transfer a certain percentage of your wages for safe keeping.

Here’s a tip from Lauren Thiel, a certified accountant and owner of The Real Thiel: "Have a bank account specifically for tax. I nickname mine 'not my money'. Put a little aside every week, and then when you get to the end of the year, or to your quarterly activity statements, you have the money there ready to pay to the ATO. This should relieve a lot of the financial stress around tax time because you are prepared in advance.”

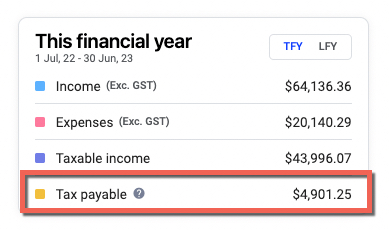

If you’re a Rounded customer, you’ll see an estimate of your income tax liability on the dashboard, which updates as you add your income and expenses. This estimate is based on the data you enter into your Rounded account, so it’s always a good idea to check the number with your accountant or the ATO.

3. Only make business purchases using your business account

Get in the habit of only using your business account to pay for things that are legitimate business expenses. This will make your life a lot easier when it comes time to file taxes because you’ll know that anything taken out of that account is tax deductible. Be sure you change any automatic bill payments or subscriptions you use for your business to the correct account.

4. Connect your business account to accounting software

Rounded users can connect their business bank account directly to the platform, making it much simpler to organise your business expenses. Once your account is connected to Rounded, you can easily go through and see all of your business transactions in one place.

In fact, sorting your expenses with Rounded is now easier than ever with our latest update, Automated Expenses. If you’ve previously added a similar expense, Rounded will review it and make suggestions for the vendor, GST status, category, and what percentage of it counts as a business expense. You can make changes if you need to of course, but this update will save you lots of time when managing your expenses.

Rounded now uses AI to automatically categorise your expenses based on previous purchases. Not using Rounded yet? Sign up for a free trial.

5. Pay yourself into your personal account.

Now comes the fun part—paying yourself! Once you have set aside money for business expenses and tax deductions, you know that the rest of the money is yours to keep. Simply transfer your remaining funds into your non-business transaction account, and you can rest easy knowing that all of those funds are yours to use as you see fit.

Learning how to use your business accounts as a freelancer takes a little bit of work at the start, but once you’ve figured out a routine, it’s smooth sailing. Getting it sorted out now means you’ll have less to worry about once tax time arrives.

Looking for more advice on how to manage your freelancer finances? Check out our Freelance Advice Library.

Cover Photo by Eduardo Soares on Unsplash

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.

-p-1600.jpeg)