How you can stop work interrupting your summer break

If you are lucky enough to be able to take a break over summer it can be a great time to relax and recharge. If you’re self-employed however relaxing and recharging is not always as easy as it sounds.

Article contents

− +

The good news is that a small amount of preparation and planning can really help you get organised before the holiday craziness making it easier to unplug, de-stress and get the most out of the time off you do have.

Manage expectations around your availability

Setting clear expectations around your availability will set the tone for your time off. It’s as important for you as it is for your clients to have a really clear understanding about when you are going to be available. This will make it easier to turn email and social media notifications off!

Ensure you have made your clients aware of when they will and won’t get a response from you. As long as deadlines and deliverables are managed you can afford to be disciplined with yourself and your clients about taking time off.

Tie up the loose ends

Knowing that you’re prepared for the new year will do wonders for your peace of mind. If you aren’t using a good accounting package to help manage your business finances we highly recommend you start! It will save a heap of time, effort and money, plus reduce the likelihood of things falling through the gaps.

Log expenses and capture receipts early to ensure your bottom line profitability doesn’t suffer. Similarly make sure any outstanding invoices are sent to clients. This is really important from a cash flow perspective as it minimises the chances of payment delays.

If you want to be super organised you should also use your accounting software to pre-schedule invoices and set auto reminders for overdue invoices. Anything you can automate removes a reason to tear yourself away from your downtime to do something work related.

Get your BAS in early

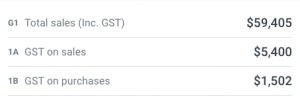

If you have to do a BAS why not get it in early? With all your expenses done and payments reconciled there’s no need to wait until the deadline to submit your BAS.

Rounded founder and career freelancer Grant McCall says:

“Because of the extended deadline I was actually lazier with my Q2 BAS than normal. I’d never be prepared and the deadline would sneak up on me. It always seemed to end up being more a hindrance than a help. I’d forget things and it would just take longer to pull all the information together.”

Rounded subscribers can use the “Activity Statement” report to get the 3 numbers they need to go to MyGov and submit a BAS in less than a minute!

This may all seem pretty obvious or trivial but it’s these little things which can be the difference between real some quality recharge and relaxation vs. partial downtime spent fretting about all the stuff which you wish you’d already done!

Contents

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.