Sole Trader vs Company. What’s the difference?

When turning your idea or passion into a business, one of the first decisions you’ll have to make is whether to set up as a sole trader or a company. This guide will help you understand how these two structures differ and how to choose the one that’s best for you.

Article contents

− +

This article was updated in December, 2022. All costs and fees outlined below are current as of that date.

Sole trader vs. Company: Freelancers usually come up against this decision when they’re launching their business.

Those who start out as sole traders may face it again, as their business grows and they begin to bring on employees or want to reduce their business liability.

This guide will cover much of what you need to consider when deciding what business structure you want.

Remember: This article has been reviewed by a tax expert, but it’s always best to seek professional advice. A tax professional or business consultant will be able to guide you to the best option, based on your personal circumstances. Here’s our guide to hiring an accountant or bookkeeper.

Overview: Things to consider

In short, registering as a sole trader is the simplest way to launch a business, and as an added bonus the ongoing paperwork is minimal. It’s easy to see why this structure is a popular choice for those starting out as a freelancer or tradesman. However, it’s important to understand the limitations, tax rates and additional personal liability you will incur as a sole trader.

If you plan to grow a substantial business over time, involve shareholders and reduce your personal liability and tax rates, then a company structure may be the better option.

Remember your business structure is not set in stone; you can always change depending on your circumstances at the time. Having said that, making the right decision from the get-go could save you a headache and extra paperwork down the track.

Let’s examine some of the key differences.

Sole Trader vs. Company: Starting Costs

The first consideration comes down to cost: The startup fees for these two structures are slightly different.

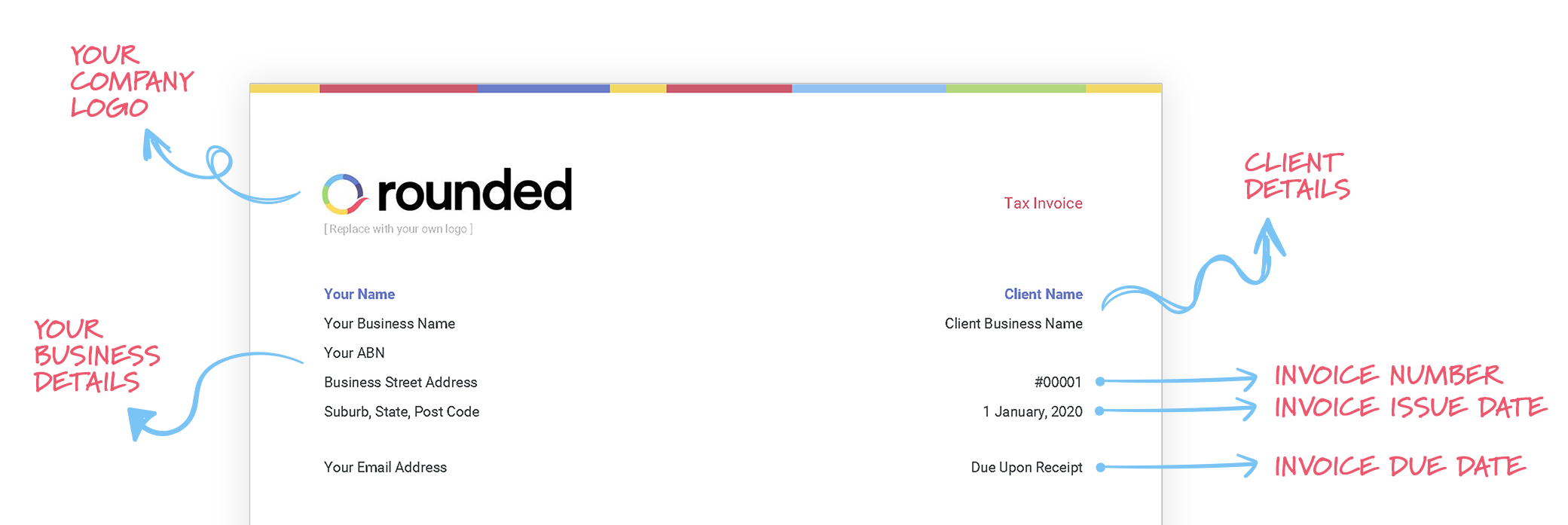

In general, there aren’t a lot of up-front costs involved when starting a business as a sole trader. No matter what structure you choose, you’ll need to start by registering for an ABN, which is free.

Once you’ve got an ABN, you may choose to register a business name, which costs $39 for a single year or you can score yourself a discount and register for 3 years at $92.

If you choose to set up as a sole trader, registering your business name is the only upfront cost.

However, registering as a company is more expensive, with a fee ranging between $445 and $538. You also may need to register your business name (and pay the fee).

Here’s a list of all fees associated with registering as a company, from the Australian Securities and Investments Commission (ASIC):

A fee of $548 may not seem like too much to set up your business as a company, but Holly Shoebridge, a tax professional and director of Oceans Accounting, offers this advice:

“Due to the documentation and additional steps involved in getting a company set up correctly from the outset, it is highly recommended to seek assistance from a professional when establishing a company. In addition to helping you get set up as a company, they will likely advise you about GST, ABN and TFN registrations. Paying for this kind of guidance up front will almost certainly cut costs down the track”

Liabilities and business debt considerations

This is one of the larger and more important differences between a sole trader vs. a company. Understanding your liability and what it means for you personally is crucial.

As a sole trader, there is no division between you as an individual and you as a business in the eyes of the Australian government. You are personally liable for all financial and tax debt your business incurs. This also means there is no distinction between personal assets and business assets. Things like your home and car can be used to repay any outstanding debt in your name.

A key advantage of a company structure over a sole trader is the ability to limit your personal liability. This is not a “get out of jail free” card; you’ll still be liable for business debts, and if you’re the director of the company, you’ll be liable for pay as you go (PAYG) withholding and superannuation debts for your employees.

“The separation of entities is a common reason sole traders may decide to incorporate,” explains Holly Shoebridge, a tax professional at Oceans Accounting. “For example, if the sole trader owns the house they live in, an investment property, and/or a parcel of shares, those personal assets can be called upon if business liabilities remain unpaid, or if business related legal ramifications were to occur. This can be, understandably, an unsettling possibility for many, which is why they opt to set up their business as a company, instead of registering as a sole trader.”

Paying taxes as a sole trader vs. company

When it comes to tax, sole traders and companies are viewed differently by the ATO.

Paying tax as a sole trader is simple; they are taxed at the same rates as an individual. We’ve previously written a handy article on tax for sole traders which explains income tax and GST in some more detail.

Sole traders enjoy a tax-free threshold set at $18,200, meaning you won’t be taxed on any income under that amount. Once you pass that threshold, your tax rate depends on how much you earn in the year.

“The current flat tax rate for a company is 25%, which is a great consideration for sole traders that may be paying tax in the higher personal income tax brackets,” says Shoebridge. “That said, it is important to keep in mind that the personal services income rules can mean that even if a business is incorporated, if there is a single individual within the entity that provides services, the related income must be distributed to that person, rather than being retained in company at the lower 25% tax rates. When that occurs, the viability of incorporating purely for access to flat company tax rate is not always available.”

Here’s a breakdown of the tax brackets for individuals and sole traders:

If you register as a company, there is no tax-free threshold. Every dollar you make will be taxed, typically at a rate of 30%.

Lodging your taxes is also a bit more complicated if you set up as a company. Sole traders need only submit an individual tax return once a year, and make quarterly tax payments. If you register your business as a company, you’ll need to file your own personal return (even if you are director), as well as a tax return on the company’s income and deductions.

Employing staff as a sole trader vs. company

Hiring a new member of your team is exciting, but there are certain tax, super, and insurance obligations you should be aware of.

No matter what business structure you choose, you may be required to obtain workers compensation insurance and pay super for your employees. (Note: Each state has its own thresholds for when you need to obtain worker’s comp. Check with your state government website for more info..)

We have guides that explain both insurance and super in more details here:

Freelancer and Sole Trader Insurance: An Overview

Your guide to sole trader superannuation

Paperwork and ongoing costs

As you might expect, the simpler the business structure the less demanding the paperwork, reporting and ongoing costs will be.

In terms of ongoing paperwork, the two key reports that need to be lodged with the ATO are an individual tax return and a business activity statement (BAS). Keep in mind that lodging a BAS is not always necessary if you’re not registered for GST. To learn more about GST and if you should register, check out our guide:

Records must be kept for at least 5 years, either paper records or electronic will keep the ATO happy. Using Rounded, our accounting software for sole traders, makes record keeping super simple and automated in most cases.

Ongoing costs are again minimal, if you have registered a business name it’ll set you back just $39 per year.

A company structure is generally more complex, and it requires more paperwork. A company must lodge an independent tax return in addition to your individual return and must keep financial records for a minimum of 7 years.

A separate bank account is also mandatory for companies. The fees and level of paperwork required will vary by institution. Check out our guide to business bank accounts for more info.

Companies are subject to an annual review by ASIC, which attracts a $290 fee.

Wrapping up

Choosing a business structure depends not only on your initial ambitions but also where you see yourself and your business in a few years down the track. Sole traders enjoy a lot of simplicity upfront but may miss out on some of the benefits of a fully-fledged company.

This information is not financial advice. Be sure to speak to your financial advisor or accountant to get the right advice specific to your circumstances.

Cover Photo by Jakob Owens on Unsplash

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.