What can you claim on tax? A guide for freelancers

“What can I claim on tax?” It’s one of the most important questions for freelancers and sole traders to understand. Here’s what sole traders need to know about tax deductions.

Article contents

− +- Introduction

- What are tax deductions?

- How do you claim tax deductions?

- How can sole traders track expenses?

- Home office expenses

- Vehicle and travel expenses

- General business operating expenses

- Repair and maintenance expenses

- Depreciating assets

- Tax deductions on personal services income (PSI)

- Final Thoughts: Empower your business with tax deductions

Note: This article is a general guide only. For advice on your specific situation, talk to an accountant, registered tax agent, or the ATO.

Running a business costs money. Annual fees, software subscriptions, home office equipment, supplies and materials, travel costs—these things add up, but fortunately, many of them count as tax-deductible business expenses.

If you want to keep as much of your own income in your pocket as possible come tax time, then understanding what you can claim on tax, and what you can’t claim, is vital.

We know it can be a bit complicated, especially if you’ve just started freelancing. In this guide, we cover some of the most common deductions for freelancers and sole traders in Australia. First, though, let’s look at what tax deductions are and how to claim them at tax time.

What are tax deductions?

A tax deduction is an expense subtracted from your taxable income. Tax deductions reduce the amount you pay taxes on.

For example, let’s say you made $75,000 in income during the financial year and incurred business-related expenses worth a total of $10,000. In this case, your taxable income would be $65,000 instead of $75,000, reducing the amount of tax you owe for that year.

In Australia, most expenses related to running your business can be claimed as tax deductions.

According to the Australian Taxation Office (ATO), a business expense must meet three criteria to be claimable as a tax deduction:

The expense must directly relate to operating your business and not be for personal use.

If the expense is for both business and personal use, you can only claim the portion of the cost that is used for your business.

You must have records to prove it. Note that having a ‘record’ doesn’t always mean you need a receipt. We’ll cover this in more detail in ‘What can I claim on tax without a receipt?’ below.

How do you claim tax deductions?

Tax deductions can be claimed via your annual tax return. If you’re set up as a sole trader, you can claim deductions in the ‘Business and professional items’ section of your individual tax return. You can either do this yourself by lodging online with MyTax, or by using an accountant or tax agent.

If you’re set up as a company, you’ll need to claim deductions in your company tax return.

How can sole traders track expenses?

Keeping track of expenses is important, but it can be very time-consuming without the right tools and processes.

You could manage your taxes through your own system, such as a spreadsheet where you manually enter your expenses item by item. But that can be very tedious, not to mention it’s easy to fall behind and lose money to missed expenses.

Fortunately, there are automated systems like Rounded, designed to make it much easier to track your expenses throughout the year. Rounded connects with all major Australian bank accounts, and makes tracking expenses easier and faster.

You’ll be able to review them in just a few clicks, and share time directly with your tax accountant come tax time.

Not only does a system like this save time and maintain accuracy—it shows you exactly where your money is going. This gives you the insights you need to streamline and grow your business.

If you have an ABN and are operating as a sole trader business in Australia, here are some of the most common freelancer tax deductions you should have on your radar.

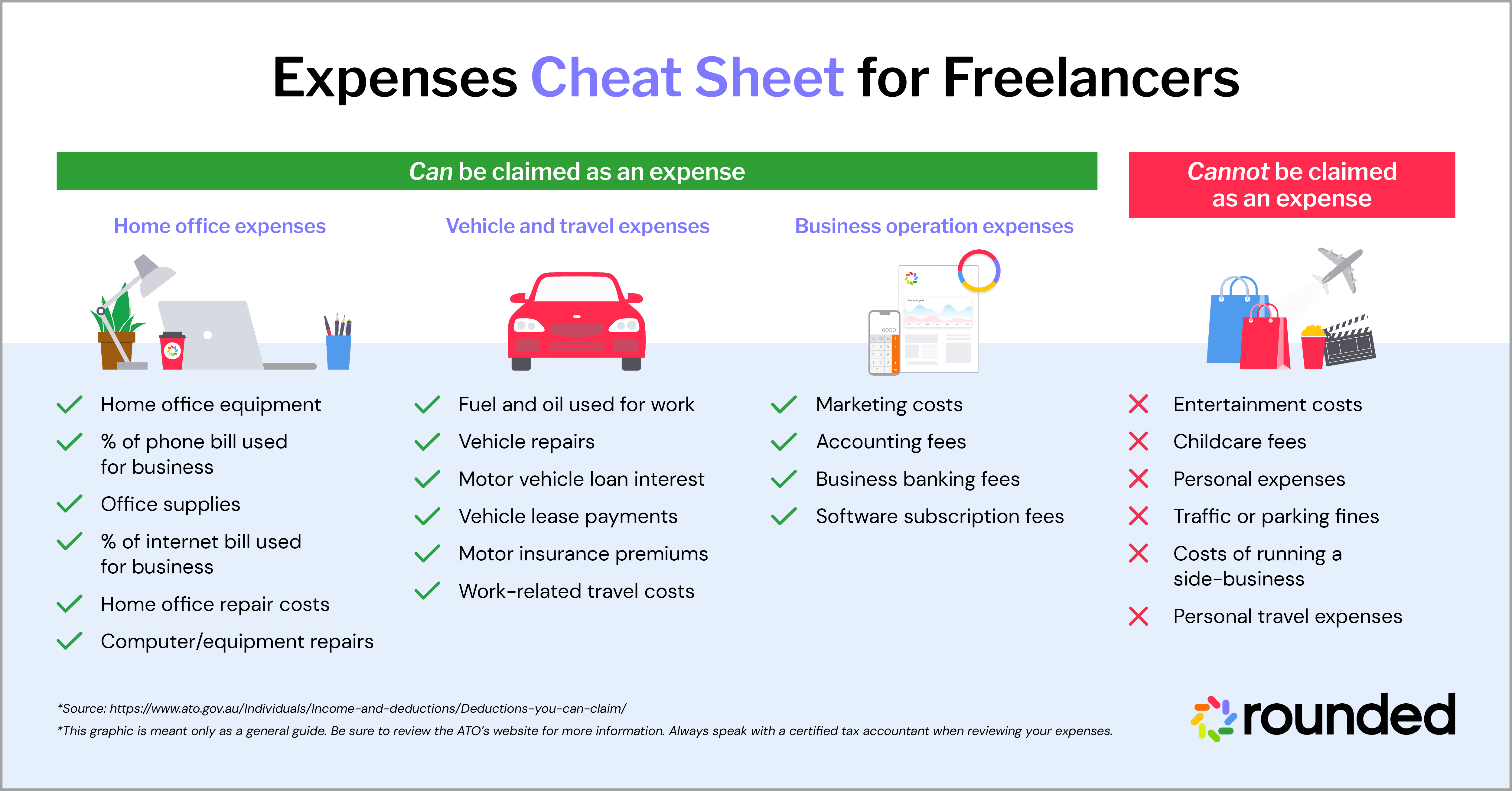

Home office expenses

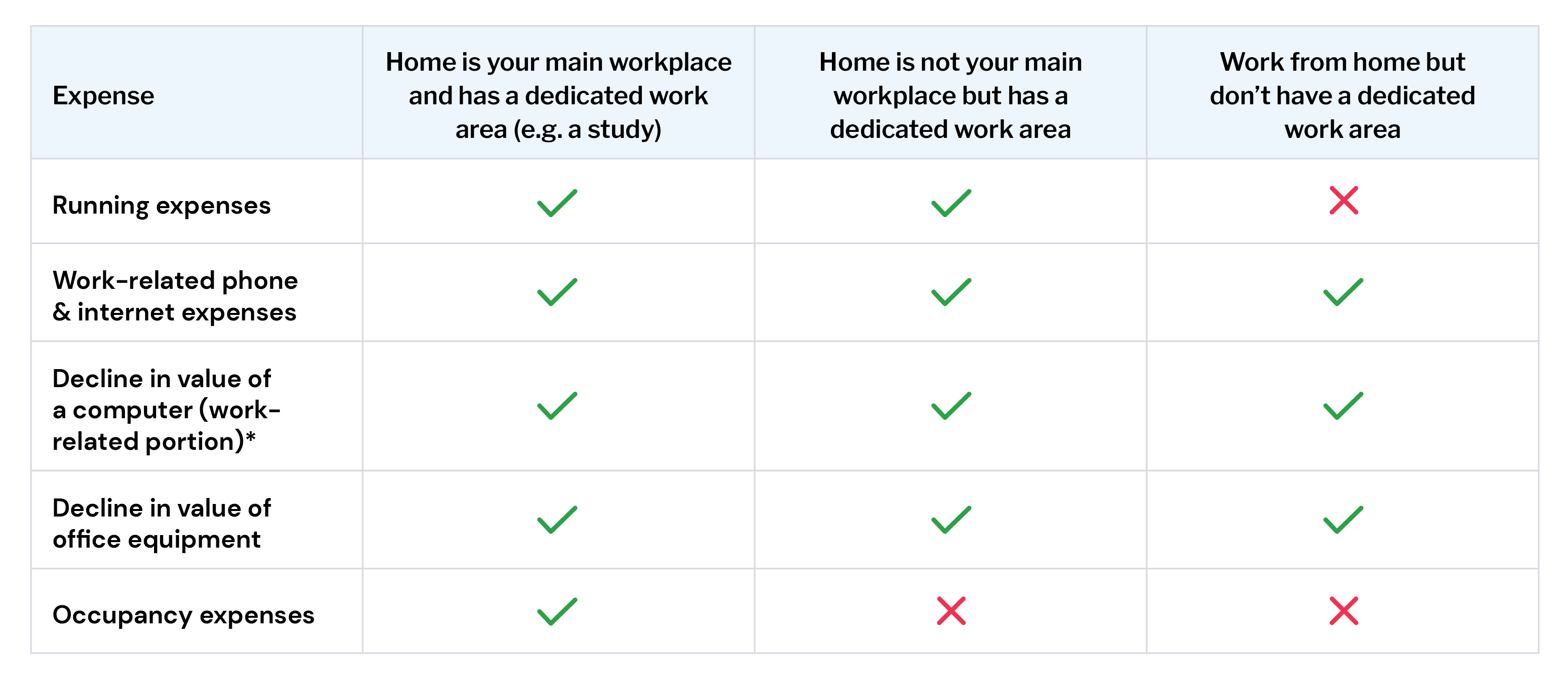

If you work from home some or all of the time, you may be able to claim tax deductions for home-based business expenses. This includes:

Running expenses

This covers the equipment, tools, and other physical goods you need to run your business.

Home office equipment, including computers, printers, phones and home office furniture.

Utilities, including phone, internet, electricity and gas.

Cleaning costs.

Repair costs, including the cost of repairs to home office furniture or fittings.

General home office costs, including stationery, printer paper and ink.

Using the fixed-rate calculation to figure out running costs

To make calculating the cost of running expenses easier, the ATO allows sole traders to deduct a fixed rate of 52 cents for each hour you work from home.

For example, if you work 38 hours from home during a week, your allowable running expenses deduction for that week would be:

38 x .52 = $19.76

This calculation covers the cost of business expenses that might be harder to track, like heating, cooling, lighting, cleaning and the decline in value of furniture.

If you use this method, you’ll still need to separately keep track of other office expenses. These might include:

The portion of your phone and internet bills used for work

Stationery

Decline in value on computers or other equipment

Alternatively, you can manually calculate and deduct all running expenses, but you’ll need to maintain records—such as a diary of the number of hours you work from home for the year—to prove your claim is reasonable.

Occupancy expenses

This covers the non-tangible fees and costs of running a business out of your own home.

Rent

Mortgage interest

Property insurance

Land taxes

Council rates

Calculating occupancy expenses

If you work from home and can claim occupancy expenses, you’ll need to work out the portion of your home that you use for work purposes. You can do this by calculating:

Total expenses x the percentage of your home’s floor area you use for work x the percentage of the year that part of your home was used exclusively for work

For example, if the floor area you use for work takes up 20% of your home, and you worked from home all year, you can claim 20% of your total occupancy expenses as a tax deduction.

You can also use the ATO’s home office expenses calculator to work out your allowable deductions for the year.

What you can and can't claim for home office expenses

*Note that if you are instantly writing off the cost of assets, you don’t need to claim a decline in value of computers or other office equipment. See ‘Depreciating assets’ below for more information.

Vehicle and travel expenses

If you use a car or other vehicle for work purposes, you can claim the following vehicle expenses:

Fuel and oil

Repairs and servicing

Interest on a motor vehicle loan

Lease payments

Insurance cover premiums

Registration costs

Depreciation (decline in value—be sure to see below for more information on this in the Depreciating Assets section)

Keep in mind that you can only claim vehicle expenses that relate to your business. For example, if 50% of your car use is for work, you can only claim 50% of the expenses above as a business deduction.

The ATO suggests using a logbook or diary to record your business versus personal vehicle usage.

Alternatively, you can also use the simplified ‘cents per kilometre method’ to calculate your vehicle deductions for the year. Using this method, you can claim 78 cents per kilometre (as of 2022 - 2023) for every kilometre travelled throughout the year, up to 5,000 kilometres.

Additionally, if you travel for work purposes, you can claim business-related expenses including:

Airfares

Public transport or taxi fares

Car hire fees and related costs such as fuel, tolls and car parking

Accommodation costs

Meal costs, if you are away overnight

If you’re someone who travels a lot, be sure to check out our guide to digital nomad taxes.

General business operating expenses

Outside of your home office and travel expenses, there are still plenty of costs you can claim as sole trader tax deductions.

Costs associated with running your freelancer marketing strategy

Legal expenses

Software subscription fees

Fees you pay your accountant or bookkeeper

Fees on your business bank account

Premiums on your sole trader insurance

Interest on business loans

Uniform fees

See the full list of deductible operating expenses here.

Repair and maintenance expenses

If you need to pay for work-related repairs and maintenance, you can claim these costs as deductions. This includes:

Computer or other equipment repairs

Machinery repairs

Painting

Plumbing work

Repairing electrical appliances

You don’t need to own the property or item that is being repaired or maintained to claim a deduction. However, the repairs or maintenance must relate to your business.

Depreciating assets

A depreciating asset is an asset that declines in value over time. This includes:

Computers and electronics

Cars and vehicles

Office equipment and machinery

Furniture, carpet, and curtains

If you purchase any assets up to the value of $20,000, and your business has a turnover of less than $10 million, you may be eligible to claim this expense immediately as a tax deduction in the year of purchase, by utilising what’s known as the instant asset write-off.

The $20,000 threshold will apply on a per (eligible) asset basis, so freelancers can instantly write off multiple (eligible) assets.

If you have assets that fall into this category, then it’s highly advisable you work with a tax professional and provide them with details and records of the item purchased, including:

The date of purchase

The amount you paid

Any GST withheld

What % of the purchase will be used for work purposes

A copy of the invoice or receipt

Rounded users can simply label any assets that may qualify for instant write-off under “Equipment” within their P&L statement. (Not using Rounded? Start a free trial.)

What can’t you claim on tax?

Although most legitimate business expenses are tax-deductible, there are some costs you can’t claim:

Entertainment expenses.

Traffic or parking fines.

Personal expenses, such as childcare fees.

Expenses relating to income separate to your main business. For example, if you’re a freelance designer but you make extra income selling jewellery on the side, you can’t claim deductions on expenses relating to your jewellery-making hobby.

The GST portion of an expense, if you can claim it as a GST credit on your business activity statement.

Tax deductions on personal services income (PSI)

In Australia, some freelancers and sole traders earn what’s known as personal services income (PSI).

If your work is based on your skills and expertise (rather than, say, supplying finished products), the income you receive may be classified as personal services income (PSI).

The ATO uses several criteria to determine if a business earns PSI. Even if the majority of your work is based on your skills and expertise, your income still may not be classified as PSI if you don’t meet all the criteria.

The easiest way to work out if you earn PSI is by using the ATO’s personal services income (PSI) decision tool.

If you do earn PSI, there are some business tax deductions you can’t claim. This includes rent, mortgage interest, rates and land tax.

Find out more about deductions that can't be claimed on PSI here.

What can I claim on tax without a receipt?

As mentioned above, the ATO requires freelancers (and other businesses) to keep 'records' for all expenses they claim at tax time. Rounded users can easily upload digital copies of their receipts, and submit them all at once to their tax accountant.

However, you don’t need to keep receipts for all business expenses. Here are a few situations where you don’t need receipts for tax time. NOTE: You will still need to have records of some kinds in most cases. See details from the ATO here.

Vehicle expenses. You can claim 78 cents per kilometre for every kilometre travelled throughout the year, up to 5,000 kilometres, instead of keeping records or receipts.

Home office running expenses. You can calculate a fixed-rate deduction of 52 cents for each hour you work from home instead of relying on receipts or records.

Receipts that aren’t easy to get. In some cases, when a receipt is hard to come by, you can make a claim provided you can show records of the purchase in other ways.

Smaller expenses. You may not need receipts for claims under $10, provided your total claim for small expenses is less than $200 total.

Laundry expenses. If you take your work clothes or uniforms to the cleaners and spend up to $150, you can typically claim this without a receipt.

For all work-related expenses, you can generally claim up to $300 in total without needing a receipt or proof of your claim. However, this may not be the case in your particular circumstances, so it’s best to consult with a registered tax professional.

Rounded makes expense-tracking simple for freelancers and sole traders. Here’s how it works:

Drag and drop or snap photos of your receipts via the mobile app, and they'll be safe and sound in the cloud.

Import your purchases from over 130 Australian banks to make expense tracking a breeze.

Quickly and easily log recurring expenses like phone and utility bills.

Pull up clean and organised expense records whenever you need them.

Final Thoughts: Empower your business with tax deductions

Tax deductions may seem complicated, but claiming the maximum amount of deductions gives you a competitive edge as a business.

Deductions let you keep more of your own money throughout the year. This extra income makes it possible for you to invest in the software, tools, and resources you need to run a thriving freelance business.

For more help with all things tax related, be sure to download our Ultimate Guide to Freelancer Taxes.

Contents

- Introduction

- What are tax deductions?

- How do you claim tax deductions?

- How can sole traders track expenses?

- Home office expenses

- Vehicle and travel expenses

- General business operating expenses

- Repair and maintenance expenses

- Depreciating assets

- Tax deductions on personal services income (PSI)

- Final Thoughts: Empower your business with tax deductions

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.

-p-1600.jpeg)